Wow, what a ride! Since 2009, the markets have experienced tremendous growth. Many have been surprised that the markets have performed so strongly over the past 10 years. It seems like every other week we hear of some new crisis or predictions which call for a significant market correction. It’s no wonder some have called this bull market the most hated bull market in history. While this bull market won’t last forever, it seems like there’s more gas in its tank than even we thought possible.

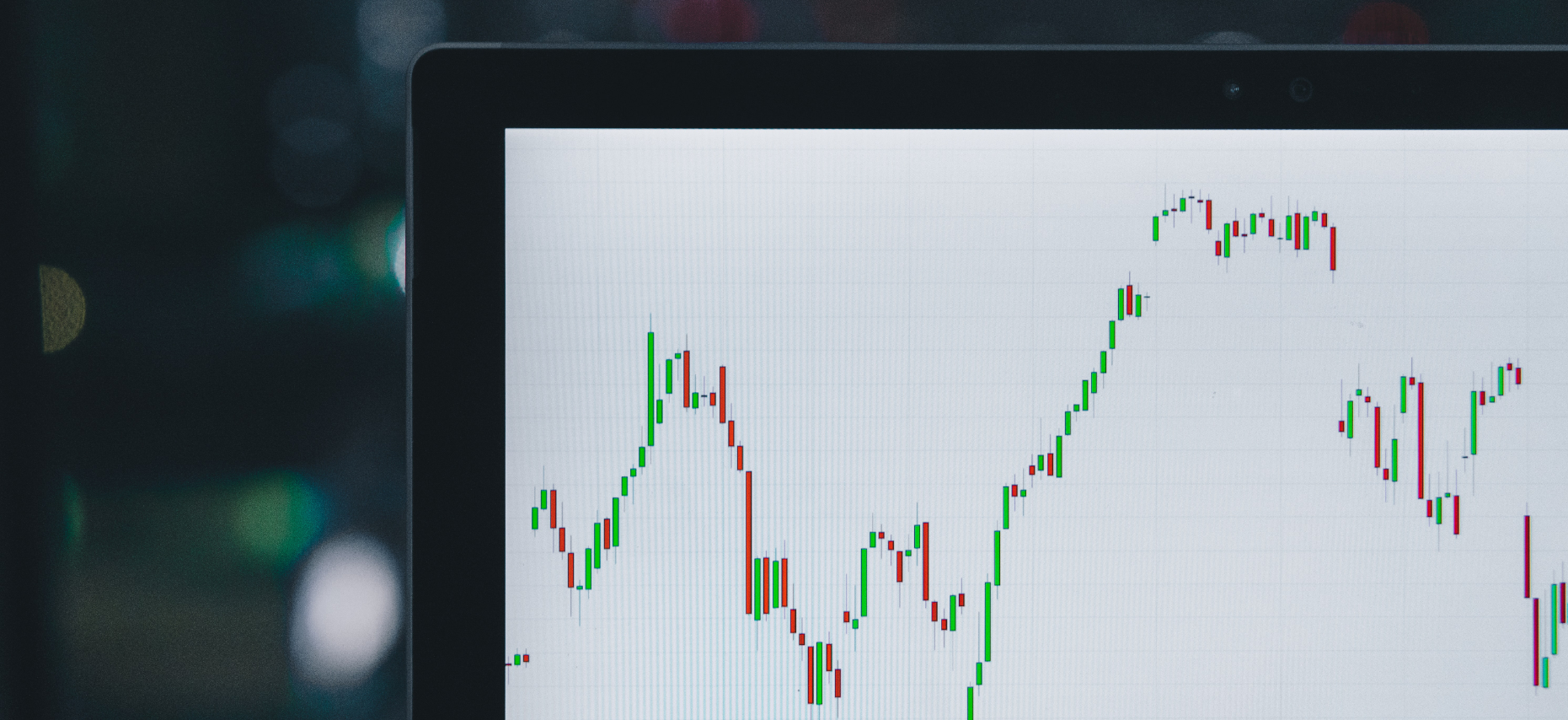

At Life Financial Group, we don’t make investment decisions based out of fear or greed. We have seen clients and friends make drastic changes to their long-term investment plans based on short-term fear-based “news”. In our experience, knee-jerk emotional decisions rarely work out well. In a recent article from Business Insider, they analyzed what would have happened to an investor who followed different predictions of “doom and gloom”. The results were disturbing. Those investors gave up significant market gains for fear of experiencing a recession. See the chart below.

Fear sells! Sensational headlines may get lots of attention but they do not offer good long-term solutions. This is why our clients rely on our ability to see through the hyperbole so that they can focus on what really matters.

This fall, we sent an email to you regarding an important portfolio update. In that letter, we addressed our concerns about increased levels of risk and our plans to reduce the level of risk in many of our clients’ portfolios. Since that time, some things have changed while others have not. Below are a few of the things that have changed since that letter.

- The economy has proven its resilience.

- The yield curve is starting to look healthy once again. The yield curve is a chart that visualizes the interest rate for different bonds based on their timeframe (i.e. a 3-month bond generally has a lower rate than a 10-year bond).

- Consumer spending remains robust, driving the retail sector higher.

- Employment keeps on getting stronger.

- Inflation remains low (1.7%).

- The Federal Reserve has started to lower interest rates. While this is not a good thing for those of us with money in the bank (cash savings), it is helpful for those who are borrowing money, buying a home, or refinancing their mortgage. This has also added fuel to the economy by driving stock prices higher.

- The trade war with China is showing signs of a peaceful resolution. The Trump administration has indicated that there will be a new trade agreement early this year. If this doesn’t come to pass, we would expect that the markets would respond negatively.

- New Middle East Tensions have sparked concern about a new conflict with Iran. This has caused oil prices to jump, which will increase the price we pay at the pump.

Some things have not changed and remain concerns. The 2020 Presidential campaign cycle is in full swing. Many of our clients are concerned about what will happen to the value of their investments if the Democrats win the White House. While these concerns are not unfounded, it is unlikely that the concerning economic policies these candidates propose will become law (provided that the party does not also win total control of both the House and the Senate). Historically, election years have been good for the stock market. Also, it is extremely rare (it’s only happened once) that an incumbent president with a strong economic tail-wind not win re-election.

What do we see in the year ahead? At this point, unless something totally unexpected happens, it is unlikely that we will see the US enter a recession in 2020. We do not expect a repeat of the amazing market performance that we experienced in 2019, but more modest gains are not out of the question. That being said, the markets move quickly and could see a healthy pullback intra-year. This is normal. See the chart below.

How are you positioned for the new year? For those of our clients investing in one of our managed portfolios (Biblically Responsible Investment portfolios or Sector Rotation portfolio), you can relax. We’ve already done the heavy lifting for you. Each of our managed portfolios has been and will continue to be adjusted to respond to market conditions. The BRI models are adjusted annually or more frequently if needed while the Sector Rotation model is adjusted quarterly.

The best thing to do is to keep in touch with your advisor if there are any changes to your goals, timeframes, and needs. If any of these change, your advisor may want to update your investment plan. If you are not using one of our managed portfolios, reach out to your advisor if you would like to see if one of these portfolios is right for you or to review your risk and positioning for the year ahead.

As you review your 2019 investment returns, you may notice that some of your accounts may be performing better than others. If one account is doing better, shouldn’t we invest all of our money there? In short, no. Those accounts that did the best typically have a higher degree of risk. Larger portfolios are normally invested with greater diversification and may not produce the eye-popping returns we see with some single funds. Smaller accounts are often invested with one fund family and often in equities or stock funds. Be patient and think long term, because in a declining market environment these high flyers often drop the most.

New Law Impacting Retirement! Late last year, the SECURE Act was signed into law. This has significant changes for retirement accounts. Some of the highlights include:

- Required Minimum Distribution (RMD) age has increased from 70 ½ to 72.

- Elimination of the Stretch IRA, forcing all non-spouse IRA beneficiaries to empty the Inherited IRA within 10 years.

- No age restriction for Traditional IRA contributions.

For more information on this new law be sure to read our recent blog post about the SECURE Act.

Thanks again for your confidence in the Team here at Life Financial Group. We value your friendship and look forward to serving your family in the years to come.

Sincerely,

Roy Russell, Tim Russell, Jeremy Ehst, Mark Magruder, Tony Greipentrog, Stephen Virkler

P.S. Tax Season is upon us! If you plan on using Beacon Tax Services be sure to forward your tax return material to as soon as possible. Click here to download the forms you need to get started.

Citations

- https://markets.businessinsider.com/news/stocks/jpmorgan-michael-cembalest-armageddonists-fuel-recession-and-bear-markets-2019-11-1028685952

- See our recent letter regarding the management of the BRI portfolios. https://mailchi.mp/thelifegroup/important-portfolio-update

Securities and Advisory Services offered through GENEOS WEALTH MANAGEMENT, INC. Member FINRA and SIPC