Psalm 46:10 “Be still, and know that I am God.”

After a rocky start to this year, it can be easy to lose sight of the fact that God is still on His throne. When we take our eyes off of God, we can miss the wonderful things that He is doing. A few days ago, by God’s grace, Roe v. Wade was overturned. This helps us to remember that God is and always has been our refuge and strength and very present help in time of trouble (Psalm 46:1). If nothing else goes right in 2022, we can all rejoice in the great work that God has done.

In this letter, we will outline the factors leading to this pullback as well as several strategies to mitigate and manage the downturn. So sit back, grab a cup of coffee, and enjoy the read.

Year to date, the markets and many portfolios have seen their values decline. With inflation at a 40-year high, stock markets dropping, and bonds not providing much support, there are major headwinds facing us. After a 5 to 10-year period of mostly positive years in the stock market, we knew we would have a negative year to deal with at some point.

Factors of Concern

Let’s take a closer look at three particular challenges facing investors this year and seek to understand what is causing the problems.

- Inflation – The most recent inflation reading shows that we have seen prices increase 8.6% over the past 12 months. Two of the biggest factors causing inflation to increase are food and energy costs. Energy has increased 34% over the past year with much of that coming in fuel oil which is up 106% and gasoline which is experiencing a 48% increase. Russia’s invasion of Ukraine and the sanctions which followed have contributed to this increase, though even prior to this event, fuel prices had risen significantly. Food prices are also up around 11%. Used vehicles are another point of interest with their prices increasing over 16%.

While there are many factors contributing to the rise of inflation, chief among them are the robust strength of the US economy in conjunction with unprecedented government stimulus during and after the COVID crisis. Essentially, the government just printed most of the money used to stimulate the economy. When there are more dollars chasing the same number of goods, prices go up.

Today, the Federal Reserve (the FED) is spending much of its time and energy combating the effects of inflation. They are doing this by seeking to slow down our economy in part by increasing interest rates.

- Stock Market Decline – One of the key ways that the FED combats inflation is by slowing down the economy. A strong economy leads to stronger inflation. The drop in the market started in November of last year when the FED indicated that they were going to start reducing the amount of support that they are offering to the markets. This was enhanced by the FED’s decision to increase interest rates and by the ongoing conflict in Ukraine.

Year to date the markets are down anywhere from 20% to 30%, depending on the index. It is anybody’s guess how long it will take for the markets to recover. Many companies were significantly overpriced prior to this downturn. There are several companies now whose current valuations are worth less than the actual amount of money that the company has in the bank. We still expect that the patient investor will be rewarded in the long run.

- Bond Pressures – Normally when the stocks go down, bonds go up. This certainly was the case during the 2020 COVID crisis. The same cannot be said about this market downturn. The feds are increasing interest rates, which sounds like it should be a good thing for bonds. However, as interest rates increase, bond values decrease. Because the FED took too long to start raising interest rates, we are dealing with a significant increase in interest rates over a short period of time. Some bond funds are down more than 10% so far this year.

While it sounds bad that bonds are down that much, it does not mean that bonds do not play an important part of a well-crafted portfolio. The current price of bonds simply reflects the price an investor would get if they sold today. As investors hold bonds until maturity they expect to get the full price of those bonds.

What’s an Investor to do?

There are many potential ways to address the investor concerns. Here are several things that investors should do during market downturns:

- Trust in the Lord, not in your own understanding (Prov 3:5). It can be so easy to buy into the lies and misinformation that bombard us on a daily basis. No, the world is not coming to an end. No, gold and Bitcoin are not the safe havens some claim them to be. No, cash is not a long-term solution to temporary market drops.

- Turn Off the News. Remember that the news media only has one goal…to sell ads. They often produce stories that trigger strong emotional reactions (like fear) to condition their audience to take action (support their sponsors).

- Have Patience. The government is not in a position at this time to provide a boost to the markets. While we haven’t seen a protracted market decline in a long time, such conditions are not unprecedented. Due in part to the government policy to increase interest rates, along with slowing economic growth, it may take some time for the economy and the markets to adjust and work through the current challenges. For this reason, staying patient and continuing to apply prudent investment principles is essential.

- Stick to the Plan. Prudent investment principles do not change from bull markets to bear markets. We believe that in order to have the best potential for investment success, the following 3 principles must be incorporated and maintained.

-

- Keep a long-term perspective. Remember, investing is more like a marathon than a sprint. Successful investors are those who stay in the race especially when it gets tough.

- Stay disciplined. Stick to your investment goals and plans, and avoid the temptation to make emotional decisions. Roller coasters often take pictures of riders at the scariest moment of the ride. If you were to judge how fun that ride was by looking at those faces, you might get the wrong idea. It’s not until you get to the end of the ride and watch the happy, smiling faces laughing about how much fun the ride is that you get a full sense of the ride. Looking at your portfolio during a downturn can feel like that snapshot on the rollercoaster. However, it doesn’t give the full picture.

- Maintain diversification. It is true that this year stocks and bonds have both suffered. While well-diversified portfolios help to reduce overall risk and volatility, they don’t necessarily prevent downturns. Those who invested in some of the most profitable companies over the past few years (Meta, Apple, Amazon, Google, and Netflix) have experienced even greater declines. Don’t gamble with God’s money, stay diversified.

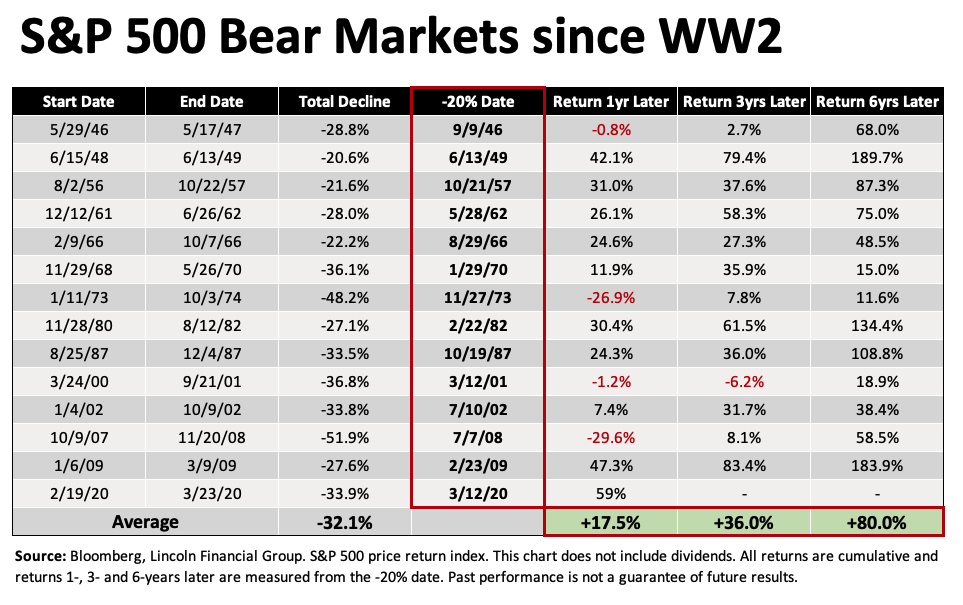

- Keep Calm and Invest On. For those able to contribute to their accounts, now may be an excellent time. Historically, bear markets have, in time, been followed by some significant bull markets. While patience and endurance are often necessary, bear markets don’t last forever (this too shall pass). While past performance cannot guarantee or predict future outcomes, the chart below shows the past 14 “bear markets.” From the time the market entered a 20% decline (bear market) it shows the rate of return 1, 3, and 6 years later. We can deduce that those who stick with the market, even when it declines by 20%, are often rewarded for their patience over time.

How is The Life Financial Group Managing Accounts through this market?

We at The Life Financial Group, Inc. (LFG) see our role as co-stewards with you of the wealth that God has entrusted to your care. We take the responsibility very seriously. As a team, we pray for wisdom and grace as we make decisions and recommendations to our clients. The following items are specific ways we are addressing portfolios at this time.

- BRI Models – Many of our clients are invested in our Biblically Responsible Investment models (BRI). We have made several tweaks to the models to help reduce some of the volatility while maintaining the overall investment objective. We have reduced the amount of money allocated to certain bond funds while increasing the allocation to others. We have also increased the amount of cash that we are holding in the majority of models.

- Roth Conversions – Bear markets are some of the best opportunities to take advantage of Roth Conversions. Investors are able to shift a larger percentage of their pre-tax retirement savings over to the after-tax Roth IRA. The amount converted is taxed as ordinary income, so if you were planning on converting $10,000 and the IRA value is 20% lower than at the beginning of the year, you can convert 20% more shares. Those shares are able to experience an eventual market recovery completely tax free (Roth Conversions must be held 5 years to avoid tax on the gain).

- Tactical Managers – There are several strategies which our advisors have been using which have proved to effectively manage risk and provide opportunities for growth.

- Real Estate – During inflationary times, real estate tends to do well. We have found certain real estate oriented investments to hold up well over the past year. On a case-by-case basis, we are discussing these options with our clients.

- Annuities – Those of you who have worked with LFG for any length of time know that we’re not huge advocates of annuities. They are a tool that can be used well provided we have the right product for the right client. At this point, there are several annuities that may be worth considering for those investors who need to reduce risk. Again, like with real estate, these will be discussed on a case-by-case basis.

Thank you for allowing us to help you become an even better steward of the resources God has entrusted to you. May God bless you as you trust Him to provide for you and your family!

Sincerely,

Tim Russell, Roy Russell, Jeremy Ehst, Mark Magruder, Stephen Virkler

LFG Advisory Team