By Tim Russell, CFP®, President & Wealth Manager at Life Financial Group

Originally shared on the Life in the Markets podcast — 10/13/2025

Subscribe on Apple Podcasts or Spotify.

*Note: you will get the most out of this market update by watching the video above*

October 13, 2025 – Are We in Tech Bubble 2.0? | U.S. vs. China Trade War Heats Up

This week, the markets continued to shrug off concerns about the ongoing government shutdown—until late Friday, when momentum reversed sharply following President Trump’s post about increased tariffs on China.

The result: a broad market selloff.

- S&P 500: -2.7%

- Nasdaq: -3.06%

- Russell 2000: -2.35%

- Gold: +3.6%

- Silver: +5.03%

- Oil: -2.1%

- Bitcoin: -5.8%

- Bonds: +0.43%

- 10-Year Treasury Yield: -2.1%, now at 4.075%

China Trade War

Until Friday, markets were trending positively. In fact, earlier that day the S&P 500 appeared poised to reach a new all-time high. That changed abruptly when President Trump announced via Truth Social a retaliatory 100% tariff on all Chinese exports to the U.S.

This move came in response to Beijing’s new restrictions on rare earth metal exports, critical components in computers and other technology. Analysts view this as an attempt by China to tighten control over the global rare earth supply chain. Trump also canceled his upcoming meeting with President Xi, escalating tensions further.

Unsurprisingly, markets disliked the renewed trade war narrative. While the selloff was sharp, it’s important to remember that news-driven events like this often fade. Historically, market pullbacks caused by geopolitical headlines tend to stabilize within weeks or months—though, of course, past performance is no guarantee of future results.

Behind the scenes, there may be more at play within China’s political structure. Reports suggest a power struggle inside the Chinese Communist Party. Some rumors indicate Xi Jinping may have experienced a health crisis, prompting his inner circle to stall trade talks. Others believe Xi may be intentionally creating a crisis to consolidate control ahead of upcoming party elections. Regardless of the truth, China’s internal developments will be worth watching closely in the months ahead.

Are We in a Tech Bubble 2.0?

Clients have been asking this question frequently—and with good reason. Depending on your perspective, we could be seeing the highs of the next decade… or the lowest prices we’ll see for years to come.

So, is the market in a bubble?

Yes and no.

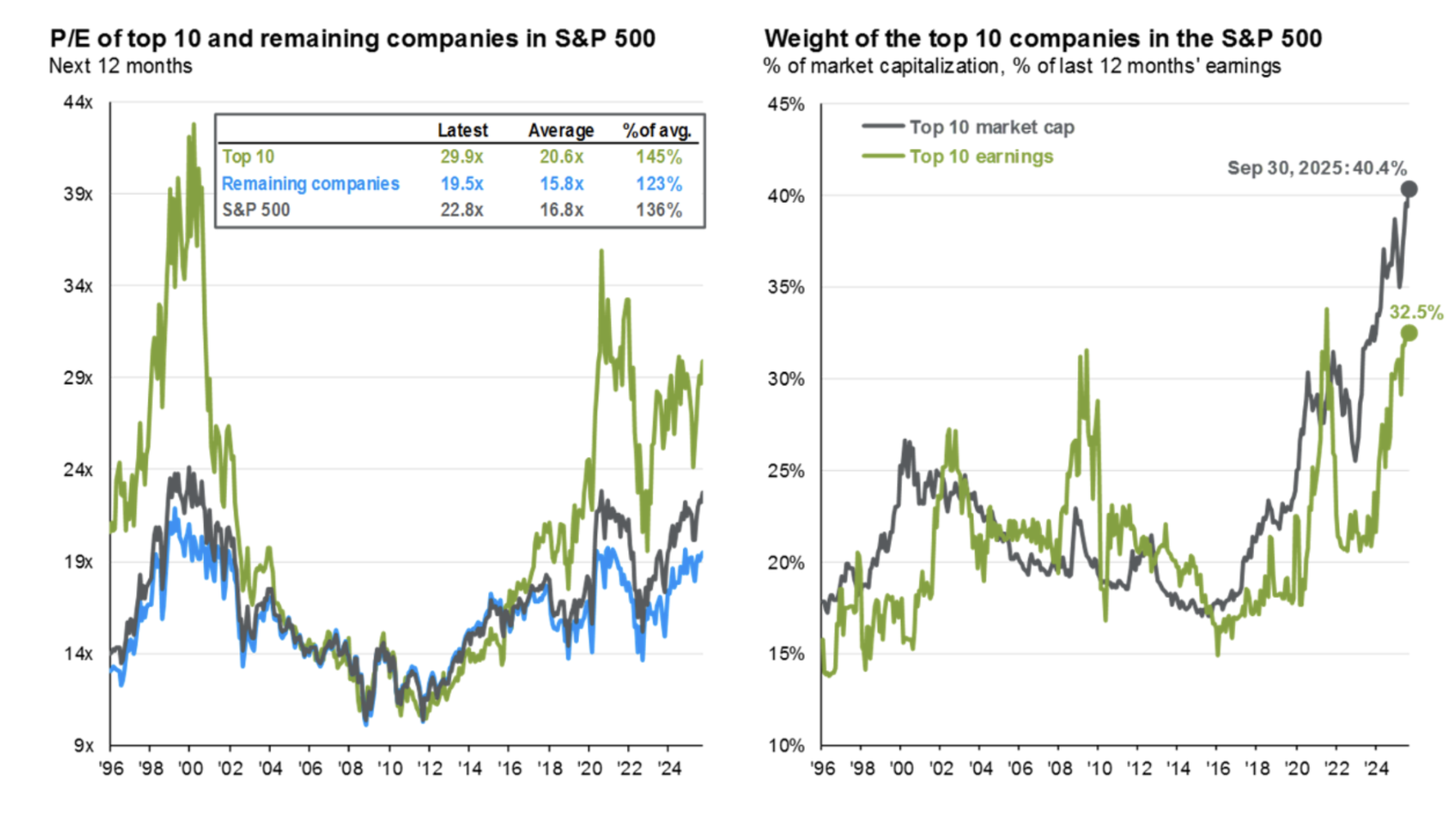

Historically, bubbles tend to be concentrated in a few sectors—think the Dot-Com Bubble (2000) or the Housing Bubble (2007). Broad, market-wide bubbles are rare, with Japan’s “Everything Bubble” of the 1980s being a notable exception. So, no, the entire market doesn’t appear to be a bubble.

However, we are seeing early signs of a new tech bubble centered around Artificial Intelligence (AI). For instance, OpenAI recently signed a deal to purchase $60 billion per year in services from Oracle—despite generating only about $14 billion in projected annual revenue. Even more concerning, the services they’re buying don’t yet exist.

To put that in perspective, the project is expected to require 4.5 gigawatts of power—the equivalent of 2.25 Hoover Dams or four nuclear plants (source: Michael Cembalest, JP Morgan).

Much of today’s AI hype is being fueled by massive cross-company spending commitments. This only works if everything goes perfectly—which rarely happens. While it’s impossible to predict when the bubble might burst, as the saying goes: “Markets can stay irrational longer than you can stay solvent.”

How Should Investors Respond?

1. Stay Diversified.

It’s tempting to chase the high returns of the S&P 500 or Nasdaq, but beware: over 40% of the S&P 500’s value comes from just 10 companies. That’s not true diversification.

2. Understand Risk Appetite vs. Risk Capacity.

- Risk Appetite: How much risk you’re willing to take for potential return.

- Risk Capacity: How much loss your financial plan can actually handle without derailing your goals.

3. Manage AI Exposure Thoughtfully.

For our clients, we’re actively assessing exposure to the AI sector. For conservative investors, we aim to limit risk where possible. For growth-oriented investors, we’re seeking AI-related opportunities with reasonable valuations, not just momentum plays.

Source: JP Morgan Guide to the Markets – U.S. Data as of September 30, 2025.

JP Morgan Guide to the Markets

Exciting RMD Update

For clients age 70½ and older, Qualified Charitable Distributions (QCDs) remain a powerful giving tool. A QCD allows you to direct your Required Minimum Distribution (RMD) straight from your IRA to a qualified charity—satisfying your RMD, supporting ministry, and keeping that amount out of your taxable income (which may also reduce taxes on Social Security).

Previously, 1099-R forms showed the full distribution as taxable, even when QCDs were made. The IRS has now issued guidance allowing IRAs to code QCDs as non-taxable, ensuring preparers report them correctly. This change simplifies tax filing and helps ensure you receive the full tax benefit of your charitable giving.

Ecclesiastes 5:10 –

“He who loves money will not be satisfied with money, nor he who loves wealth with his income…”

Stay Connected

Have questions or topics you’d like us to cover in a future episode? Email us at contact@thelifegroup.org with “Life in the Markets” in the subject line.

✅ Like, comment, and subscribe on YouTube

🎧 Listen to the audio podcast wherever you get your shows

📘 Pick up a copy of The Good Steward to grow in your financial discipleship

Disclaimer: The topics discussed here are for informational purposes only and do not constitute specific investment advice. Investing involves risks, including potential loss of principal. Past performance does not guarantee future results. Securities and advisory services offered through Geneos Wealth Management, member FINRA/SIPC.