By Tim Russell, CFP®, President & Wealth Manager at Life Financial Group

Originally shared on the Life in the Markets podcast — 11/10/2025

Subscribe on Apple Podcasts or Spotify.

*Note: you will get the most out of this market update by watching the video above*

November 10, 2025 – A Tale of Two Economies — and a Warning on Government Overreach

The markets gave back some of their recent gains this week.

- S&P 500 fell 2.23%,

- Nasdaq dropped 4%, and

- Russell 2000 lost 1.8%.

- Commodities were mixed — Gold stayed flat, Silver slipped 0.36%, Oil fell 1.9%,

- Bitcoin dropped nearly 5%.

- Bonds held steady at +0.14%, with the

- 10-Year Treasury yield sitting at 4.13%.

A Tale of Two Economies

With the ongoing government shutdown limiting access to official data, much of what we know about the economy is coming from corporate earnings reports. What we’re seeing paints a very divided picture — almost two separate economies.

On one side, the AI giants — Amazon, Alphabet, Apple, Meta, Microsoft, and Nvidia — continue to post impressive results. These companies dominate market performance and make up a disproportionate share of the S&P 500’s total weight. Their success gives the illusion that “the market” is strong and healthy.

But if you zoom out and look at the rest of the economy — manufacturing, small business, consumer goods, and traditional industries — things look far less rosy. Many of these companies are struggling, and their pain is largely being masked by the outsized performance of the AI sector.

The bottom line: The S&P 500’s headline numbers no longer reflect the true health of the broader economy. We are watching the AI economy and everything else, moving on separate tracks.

Investor Guidance: Balancing Growth and Risk

At some point, the AI frenzy will cool off — whether that’s weeks or years away, no one knows. When it does, many speculators will likely rush for the exits. Until then, how should long-term investors respond?

Here’s some practical guidance:

- If you’re years away from retirement:

Keep investing. Market pullbacks create opportunities to buy more shares at lower prices. It may also be wise to keep a small amount of cash ready in case we see a deeper correction. - If you’re adding new money to the market:

Consider dollar-cost averaging — investing gradually over several months — to smooth out volatility and reduce timing risk. - If you’ll need to spend your invested money within the next 1–2 years:

Now may be a good time to pull that cash out of the market. Short-term funds should not be exposed to market swings. - If you’re retired and taking withdrawals:

Revisit your cash reserves. Make sure you have enough on hand to weather an extended downturn without having to sell investments at a loss.

In short, we do not believe investors should abandon the market or move entirely to cash, but wisdom and preparation are key.

Mamdani’s Victory Speech and the Role of Government

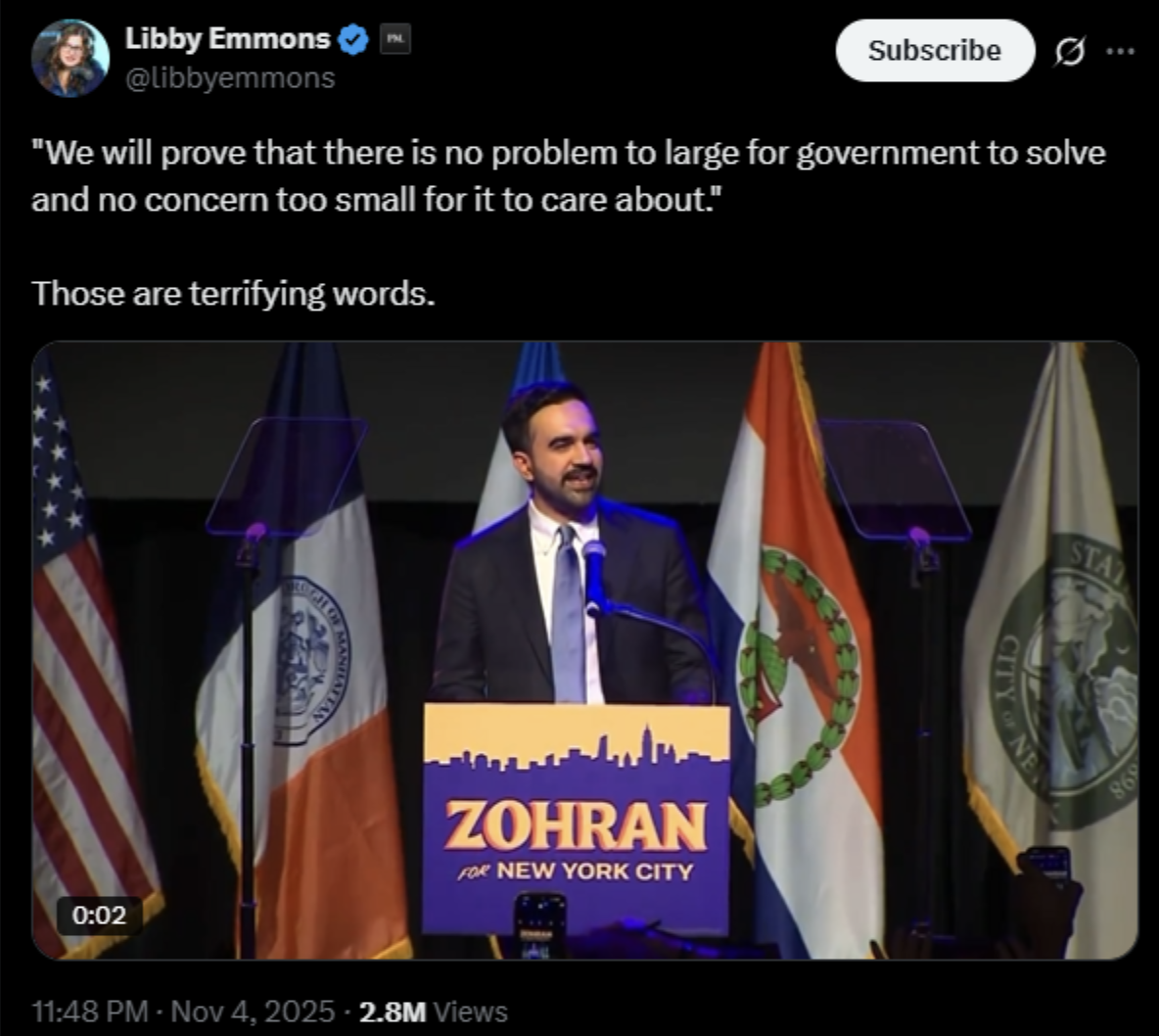

New York City’s mayoral election delivered a jolt to the political landscape. Zohran Mamdani, a self-described socialist and progressive, secured victory with promises to lower housing and food costs by redistributing wealth and expanding government programs.

In his victory speech, Mamdani declared:

“We will prove that there is no problem too large for government to solve and no concern too small for it to care about.”

These words reveal a deeply troubling worldview, one where government is the solution to every problem, no matter how large or small. This philosophy, whether labeled socialism or communism, has repeatedly failed wherever it has been tried. Every truly socialist system eventually collapses under its own weight, leaving citizens impoverished and freedoms stripped away.

The truth is, no central planner can ever understand or manage the infinite complexities of human society. The only system proven to bring both prosperity and liberty is a free market, where individuals are free to work, trade, and innovate without excessive government interference.

If we truly want to help the poor, we must reject policies like rent control, minimum wage laws, and endless “handouts” that distort the market and restrict opportunity. As Thomas Sowell famously said:

“Socialism in general has a record of failure so blatant that only an intellectual could ignore or evade it.”

“Socialism is a wonderful idea. It is only as a reality that it has been disastrous.”

Mamdani’s message resonates with many because of years of misguided policies — from Democrat-led overspending to Trump-era tariffs that fueled inflation. But the answer is not more government control. What America needs is a government that steps back, allowing free people to live, trade, and prosper without unnecessary regulation.

Wise, limited regulation has its place — to protect against fraud, abuse, or harm — but when government overreaches, prosperity withers.

Looking Ahead: Retirement Contribution Limits Rising in 2026

Although the official IRS numbers have been delayed due to the shutdown, we already have strong projections for 2026 retirement contribution limits:

- 401(k), 403(b), and 457 plans:

$24,500 (up from $23,500 in 2025) - Catch-up contributions (age 50+):

$8,000 (up from $7,500) - IRAs (Traditional & Roth):

$7,500 (up from $7,000)

Catch-up for age 50+ expected to rise to $1,100 - Health Savings Accounts (HSAs):

$4,400 for individuals (up $100)

$8,750 for families (up $200)

These modest increases reflect ongoing inflation but provide savers a bit more room to contribute toward their long-term goals.

Final Thoughts

We are living in a time of extremes — booming AI-driven profits on one side, stagnating real-world industries on the other; ambitious government expansion in politics, and a pressing need for economic freedom in policy.

As investors, the wisest path is one of balance: stay invested, stay informed, and avoid the emotional swings of the market. As citizens, we must remember that prosperity is born from freedom — not from the promises of government control.

Stay Connected

Have questions or topics you’d like us to cover in a future episode? Email us at contact@thelifegroup.org with “Life in the Markets” in the subject line.

✅ Like, comment, and subscribe on YouTube

🎧 Listen to the audio podcast wherever you get your shows

📘 Pick up a copy of The Good Steward to grow in your financial discipleship

Disclaimer: The topics discussed here are for informational purposes only and do not constitute specific investment advice. Investing involves risks, including potential loss of principal. Past performance does not guarantee future results. Securities and advisory services offered through Geneos Wealth Management, member FINRA/SIPC.