By Tim Russell (President & Wealth Manager) & Steve Virkler (Wealth Manager) at Life Financial Group

Originally shared on the Life in the Markets podcast — 2/9/2026

Subscribe on Apple Podcasts or Spotify.

*Note: you will get the most out of this market update by watching the video above*

The major theme this year is a shift away from growth and large-cap stocks toward value and smaller-cap stocks. We could say that the risk appetite of the past few years is being replaced by a more value-oriented bias.

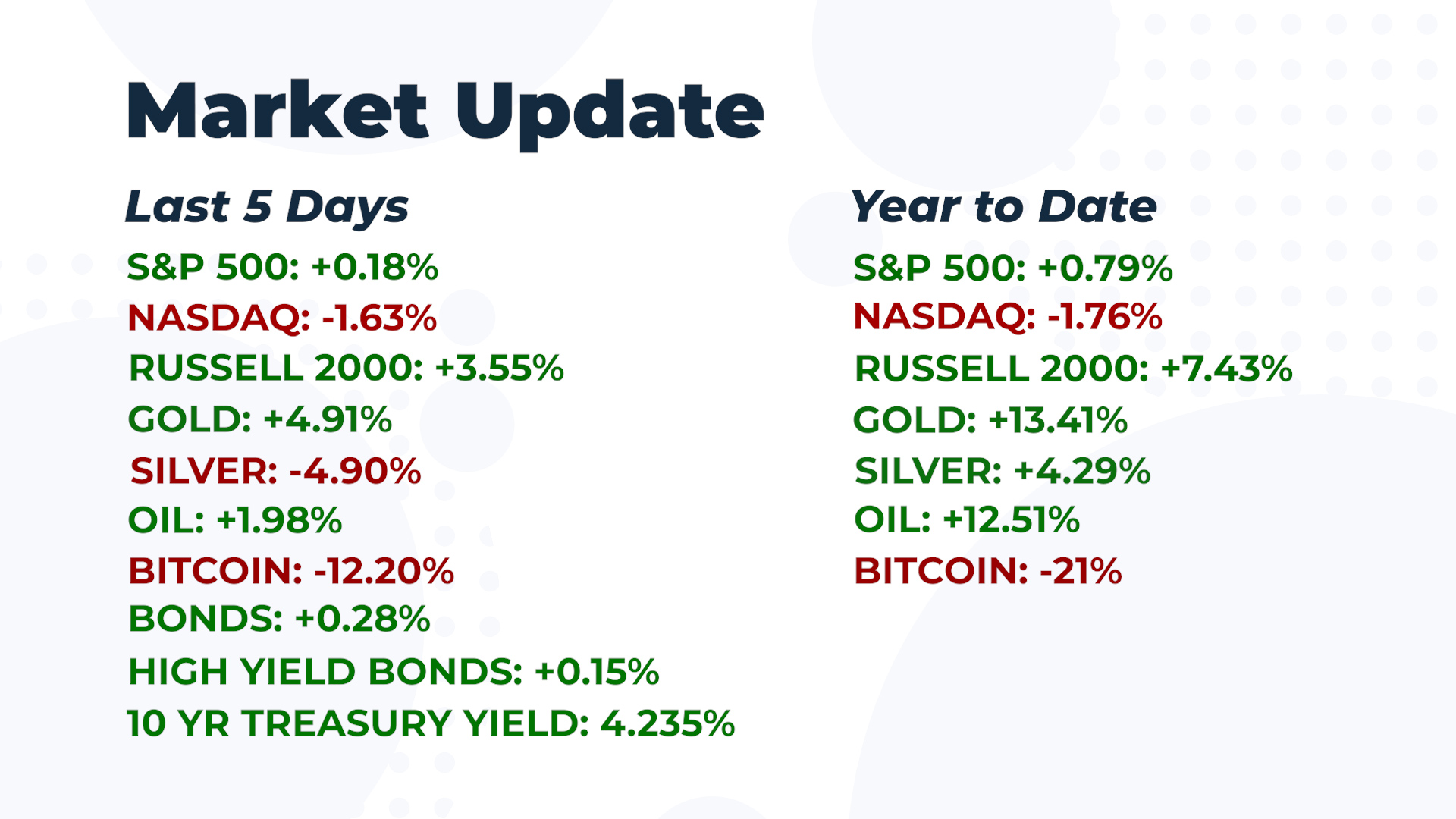

We just discussed the S&P 500 and noted how it’s up only 0.79% YTD. As discussed previously on the podcast, the S&P 500 is a cap-weighted index. This means that the larger a company is, the more weight it has in the index. Compare this to the equal-weighted S&P 500, which is up 5% YTD.

This tells us that the large names that have been driving the market in the past are taking a back seat so far this year. That said, we are still early in the year, and there is plenty of time for this trend to reverse. I would not go changing your investment plans based on just one month’s worth of market activity.

See this chart from FINVIZ.com. I want you to notice two things. First, not every company has the same size box. This represents the weighting of each stock in the S&P 500 index and the relative size of each company. Second, notice the red, gray, and green colors. These show YTD performance. We can see that many large companies are gray or red, while many smaller companies are green.

Commodities: Volatility Is the Word

Precious metals have experienced extreme volatility, particularly gold and silver.

- Gold remains up roughly 13% year to date, but that number hides sharp short-term drops, including a steep decline over just a few trading days.

- Silver, while still positive on the year, suffered dramatic losses during the same period.

The takeaway isn’t that gold and silver lack value—but rather that volatility risk is real, even in assets often viewed as “safe havens.”

Bitcoin and Speculative Assets: Buyer Beware

Bitcoin continues to demonstrate why speculative assets demand caution. The cryptocurrency is down more than 20% year to date and has lost over 50% of its value since last fall. Rapid gains and steep declines can happen just as quickly. Investors should be sober-minded and realistic about the risks involved.

Bonds Holding Steady…Quietly Encouraging

Despite rising Treasury yields, bonds have remained relatively stable so far this year. That resilience is somewhat surprising and mildly encouraging, particularly given ongoing concerns about inflation and interest rates.

Manufacturing, Employment, and the Broader Economy

Recent economic data provides some bright spots:

- U.S. manufacturing activity showed its strongest expansion in decades.

- Employment data continues to defy recession fears, with jobless claims remaining relatively low.

- Consumer confidence is improving, especially among households with larger investment portfolios.

These signals suggest that economic strength is broadening beyond just technology and financial markets.

Understanding the “K-Shaped” Economy

Much has been made of the so-called K-shaped economy, where wealthier households fare better while lower-income households struggle. While this dynamic is real, it’s also not new.

Those with assets tend to weather inflation and economic volatility more effectively than those without. That reality underscores the importance of stewardship, responsibility, and wisdom—especially for those entrusted with greater resources.

Why the Shift from Growth to Value Matters

For years, the market’s performance was heavily skewed by a handful of massive companies. The S&P 500, being a cap-weighted index, gives more influence to the largest firms.

However, when you look at the equal-weighted S&P 500, a different picture emerges. That version of the index—where each company carries the same weight—is up roughly 5% year to date. In other words, the average stock is doing better than the headline index suggests.

Market heat maps confirm this trend: many large companies are lagging, while smaller firms are showing widespread gains. This broadening participation is a healthy sign for long-term market stability.

A Word of Caution for Investors

While this shift from growth to value is encouraging, one month does not make a permanent trend. Market leadership can change quickly, and patience is essential. Rather than reacting impulsively, investors should observe whether this rotation continues over the coming months before making significant strategy changes.

A Stewardship Perspective

As a reminder, markets and assets—whether stocks, gold, or cryptocurrencies—are never meant to be ultimate sources of security.

The words of James 5:1–6 offer a sobering reminder not to place our trust in wealth itself, but to steward resources faithfully, treat others justly, and pursue righteousness in how we earn, invest, and deploy money.

Final Thoughts

The early signs of a market shift from growth to value are real and worth watching closely. If the trend continues, it could mark a healthier, more balanced phase for investors and the broader economy alike.

As always, wisdom, patience, and faithfulness matter more than chasing the latest market headline.

Have a great week—and be wise in the markets.

Stay Connected

Have questions or topics you’d like us to cover in a future episode? Email us at contact@thelifegroup.org with “Life in the Markets” in the subject line.

✅ Like, comment, and subscribe on YouTube

🎧 Listen to the audio podcast wherever you get your shows

📘 Pick up a copy of The Good Steward to grow in your financial discipleship

Disclaimer: The topics discussed here are for informational purposes only and do not constitute specific investment advice. Investing involves risks, including potential loss of principal. Past performance does not guarantee future results. Securities and advisory services offered through Geneos Wealth Management, member FINRA/SIPC.