By Stephen Rohrer, Wealth Manager at Life Financial Group

Originally shared on the Life in the Markets podcast — 12/22/2025

Subscribe on Apple Podcasts or Spotify.

*Note: you will get the most out of this market update by watching the video above*

Good morning & Merry Christmas! Welcome to Life in the Markets. I am Stephen Rohrer, Wealth Manager at Life Financial Group. We are recording this on Monday, (Dec. 22nd, 2025 ) and there are only 3 days left till Christmas.

What Happened in the Markets Last Week?

- Last week, the markets dipped down and then mostly came back ending the week nearly flat. The S&P500 ended the week up 0.1%, the Dow Jones Industrial Average slightly down at -0.7%, and the tech heavy NASDAQ at 0.5% up. Spot gold prices rose a bit and ended the week at $4,347/oz. Silver rose 8.4% last week and hit a new high of $67.45 mid-day on Friday.

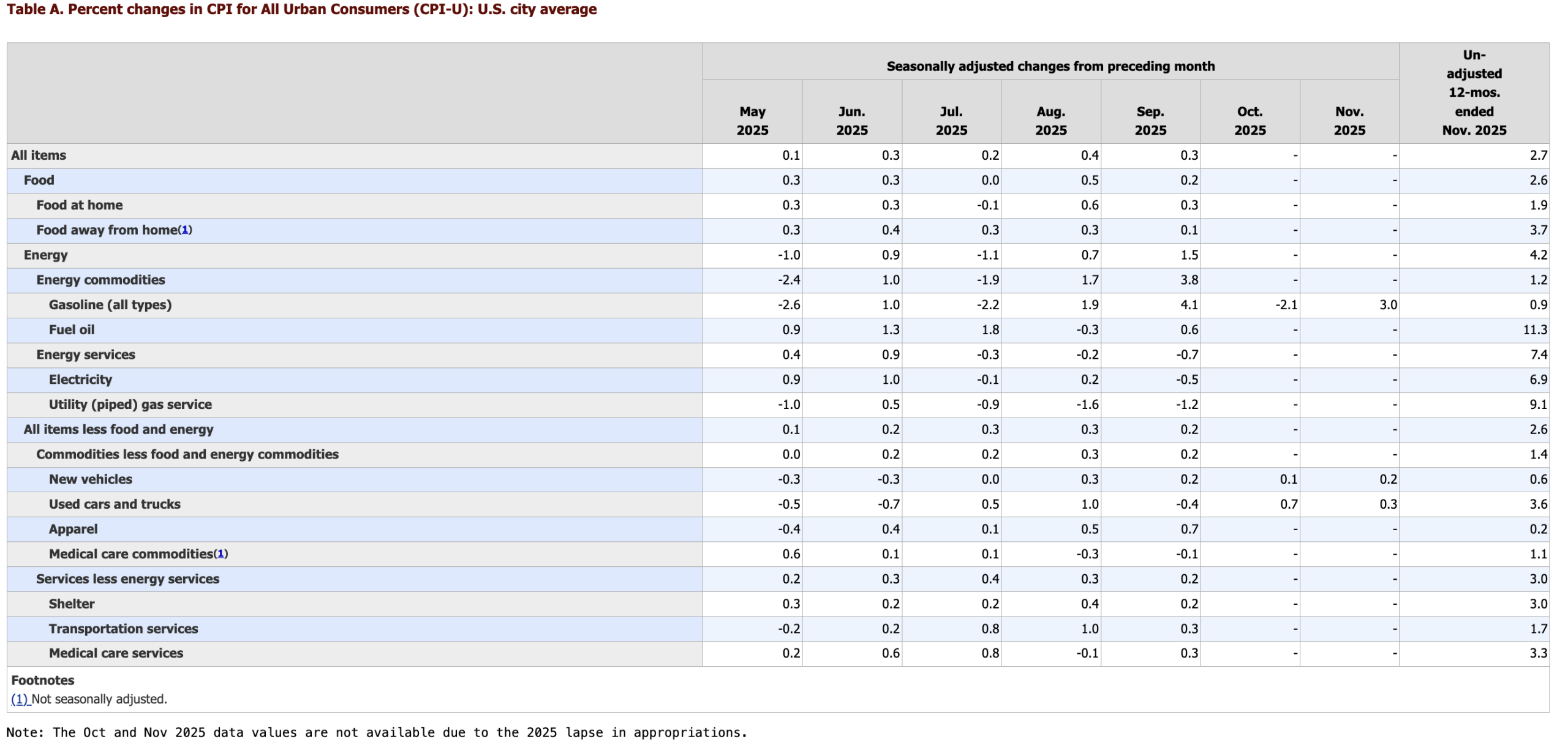

- The Bureau of Labor Statistics released the inflation report. It’s low – which is good considering they had no increase/decrease listed for most items from October and November because of the shutdown. Since the measure is a cumulation of the changes in the last 12 months, having two months with zero increase should certainly result in a “lower” 12-month sum total. To put it another way, if you were calculating your yearly expenses for the last 12-month period, but you didn’t include the most of the expenses from the last two months of the period, your “expenses” would be dramatically less for the year too.

https://www.bls.gov/news.release/cpi.nr0.htm

- In other words, the CPI report tells us almost nothing meaningful.

- The annualized U.S. existing home sales from last month held at 4.13M. This was as forecasted, but considering these numbers are similar to the existing home sale numbers from the 1990s, it’s not great. (There was a vastly smaller US population 30 years ago). However, this is likely due to homeowners with low interest rates not moving. The Fed. rate cuts may help encourage more movement – but of course, even with the rate cuts, mortgage rates are still much higher than the 2-3% rates we were seeing a few years ago.

- Otherwise, there was some shift

- Internationally, there are some positive elements from this year. Germany is putting 500billion euros into infrastructure and defense. At Trump and Rubio’s continued pushing, NATO members are committing to spend 5% on defense instead of the current average of 2%.

What could we see in the future?

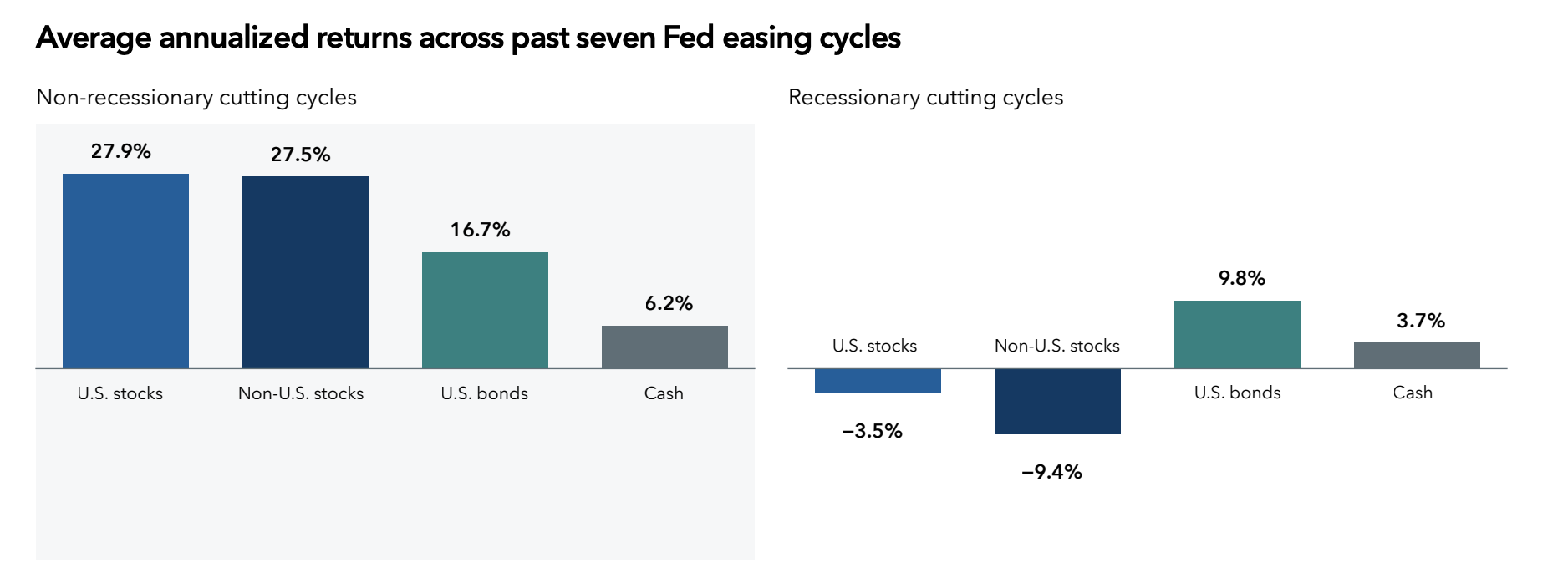

- Will the market continue to climb into next year? Certainly we do not know. However, the general economic indicators are still positive or neutral. Most likely the market gains will come from a broader cross-section of industries and sectors. As this chart from Capital Group highlights, the market has performed well in the non-recessionary rate cutting periods (average ~28% return for S&P and ~17% for US Bonds for the three such periods since 1984). But again, given the high valuation of the growth companies, adding more value/defensive companies is probably sound. Largely because of the very high valuations, we should not be shocked if there is some market pullback next year.

See page 5 and page 7 of this Capital Group report.

- What is a growth company vs a value company? A growth company is usually a younger company that is focused on expansion, i.e. reinvesting profits back into the company, which often translates to a more growth in stock price and may be more volatile. A value company is usually a more mature, established company that is in a more stable situation. Value companies also often are dividend payers where growth companies usually do not pay dividends.

- I think adding companies that are consistently growing their dividend achieves the defensive positioning as a byproduct of the dividend evaluation.

What You Need To Do

Go celebrate the birth of our Savior. Spend time with family and friends. The market can wait. Rest and Rejoice!

Bible Verse

Isaiah 9:2-7

[a] The people who walked in darkness

have seen a great light;

those who dwelt in a land of deep darkness,

on them has light shone.

3

You have multiplied the nation;

you have increased its joy;

they rejoice before you

as with joy at the harvest,

as they are glad when they divide the spoil.

4

For the yoke of his burden,

and the staff for his shoulder,

the rod of his oppressor,

you have broken as on the day of Midian.

5

For every boot of the tramping warrior in battle tumult

and every garment rolled in blood

will be burned as fuel for the fire.

6

For to us a child is born,

to us a son is given;

and the government shall be upon[b] his shoulder,

and his name shall be called[c]

Wonderful Counselor, Mighty God,

Everlasting Father, Prince of Peace.

7

Of the increase of his government and of peace

there will be no end,

on the throne of David and over his kingdom,

to establish it and to uphold it

with justice and with righteousness

from this time forth and forevermore.

The zeal of the Lord of hosts will do this.

Stay Connected

Have questions or topics you’d like us to cover in a future episode? Email us at contact@thelifegroup.org with “Life in the Markets” in the subject line.

✅ Like, comment, and subscribe on YouTube

🎧 Listen to the audio podcast wherever you get your shows

📘 Pick up a copy of The Good Steward to grow in your financial discipleship

Disclaimer: The topics discussed here are for informational purposes only and do not constitute specific investment advice. Investing involves risks, including potential loss of principal. Past performance does not guarantee future results. Securities and advisory services offered through Geneos Wealth Management, member FINRA/SIPC.