By Tim Russell, CFP®, President & Wealth Manager, and Stephen Rohrer, Wealth Manager at Life Financial Group

Originally shared on the Life in the Markets podcast — 12/15/2025

Subscribe on Apple Podcasts or Spotify.

*Note: you will get the most out of this market update by watching the video above*

Market Update

This week, markets largely shrugged off the widely anticipated ¼-percent rate cut. Leadership rotated away from large-cap growth stocks and toward smaller, value-oriented names.

Weekly performance:

- S&P 500: -0.69%

- Nasdaq: -2.18%

- Russell 2000: +1.51%

- Gold: +2.74%

- Silver: +7.90%

- Oil: -4.15%

- Bitcoin: -2.04%

- Bonds: -0.20%

- The 10-year Treasury yield now stands at 4.184%.

Yield Curve Changes

If you ask my wife, one of the most boring topics I talk about is the yield curve. At the risk of boring both her and you, it’s worth revisiting here because of its importance in understanding risk and market behavior.

The yield curve describes the relationship between interest rates and the maturity lengths of bonds. Under normal conditions, longer-term bonds offer higher interest rates than shorter-term bonds. This makes sense: the longer you commit your money, the more risk you assume, and investors expect greater compensation for that risk.

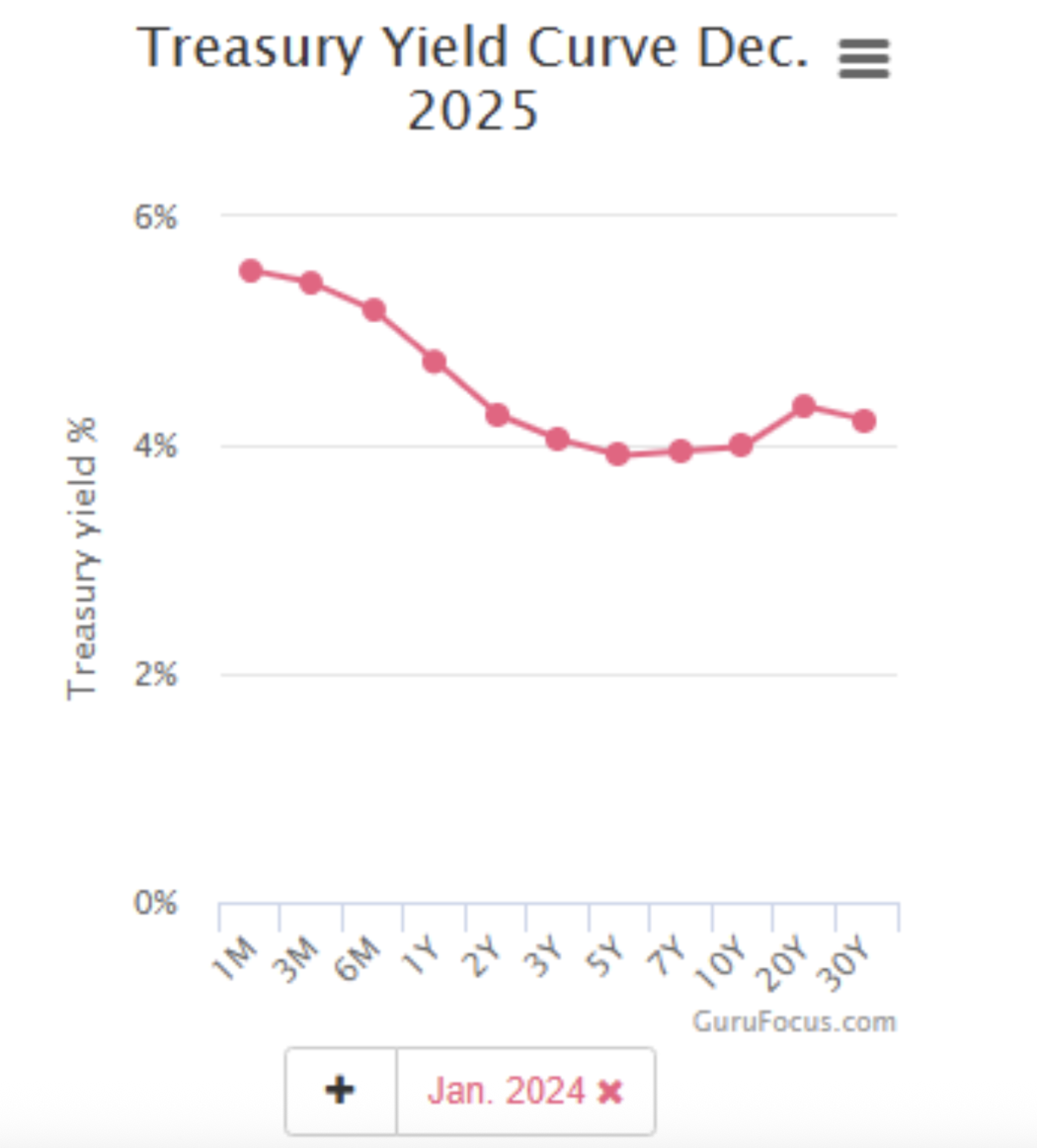

Over the past few years, however, we experienced an inverted yield curve, where short-term interest rates were higher than long-term rates. This inversion typically reflects heightened concern about near-term economic risk. In January 2024, for example, the 1-month Treasury yielded nearly 5.5%, while the 3-, 5-, 10-, 20-, and 30-year bonds all hovered near 4%.

Historically, an inverted yield curve has often preceded a recession within six to twelve months. While not a perfect predictor, it has proven to be a fairly reliable signal.

What We’re Seeing Now

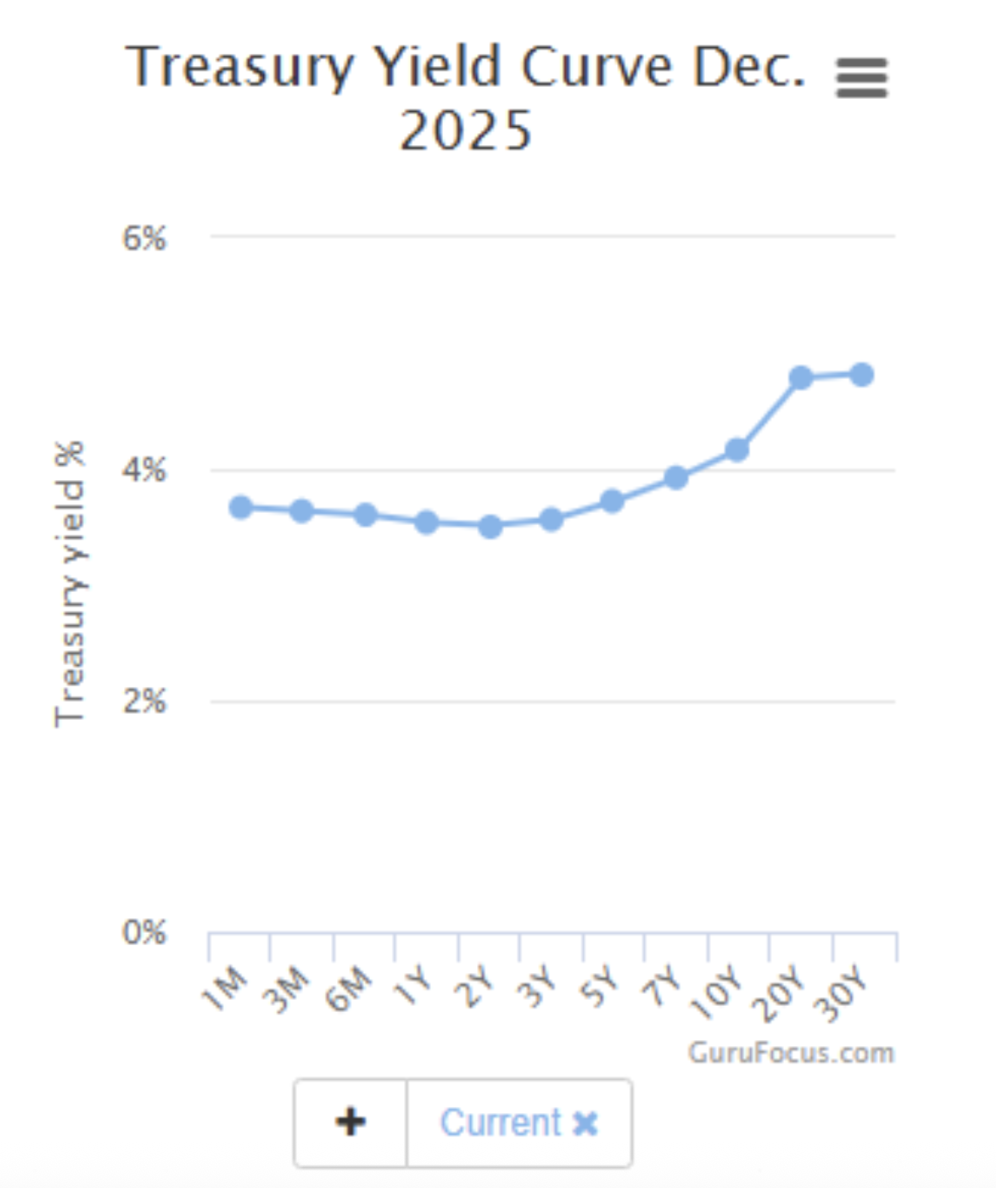

That inversion has been steadily resolving, and today’s yield curve looks far more normal. The slope is once again upward, suggesting that market conditions may be stabilizing. Despite ongoing challenges—tariffs, persistent inflation, and softening employment—the economy has so far avoided a recession.

The Federal Reserve’s recent rate cut continued a trend that was already underway. Short-term rates are falling, which means yields on savings accounts and CDs are beginning to decline. At the same time, longer-term rates have been drifting higher.

Mortgage rates reflect this dynamic. While they remain elevated compared to pre-2022 levels, they have moved lower over the past year. According to Freddie Mac, the national average 30-year mortgage rate is 6.22%, down from 6.72% one year ago (December 17, 2024) and well below the 7.79% rate seen in late October 2023.

This matters because reductions in the federal funds rate primarily affect the short end of the yield curve. They do not have an equivalent impact on long-term rates or mortgage borrowing costs, which are driven by longer-term economic expectations.

Verse of the Week

Proverbs 22:26–27

“Be not one of those who give pledges, who put up security for debts…”

Stay Connected

Have questions or topics you’d like us to cover in a future episode? Email us at contact@thelifegroup.org with “Life in the Markets” in the subject line.

✅ Like, comment, and subscribe on YouTube

🎧 Listen to the audio podcast wherever you get your shows

📘 Pick up a copy of The Good Steward to grow in your financial discipleship

Disclaimer: The topics discussed here are for informational purposes only and do not constitute specific investment advice. Investing involves risks, including potential loss of principal. Past performance does not guarantee future results. Securities and advisory services offered through Geneos Wealth Management, member FINRA/SIPC.