By Tim Russell, CFP®, CKA® (President & Wealth Manager) and Stephen Rohrer (Wealth Manager), at Life Financial Group

Originally shared on the Life in the Markets podcast — 1/12/2026

Subscribe on Apple Podcasts or Spotify.

*Note: you will get the most out of this market update by watching the video above*

Mark Cuban, the famous investor and Shark Tank personality, has said, “The only constant in business is change.” This simple truism is helpful to reflect on as we enter a new year. 2025 brought about great change. We have a new president and administration. While the inauguration itself was what you would expect, the impacts of his many policies and presidential orders were significant, and in many ways positive for both the economy and culturally from a Biblical Worldview. There is a new tax law. America’s relationships with some of its global peers have changed. The price of oil is down and the price of gold and silver are up. In the Christian world, we lost some giants: John MacArthur, Voddie Baucham, and Charlie Kirk.

Yet, as Solomon said in Ecclesiastes, “What has been is what will be, and what has been done is what will be done, and there is nothing new under the sun” (Eccl 1:9 emphasis added). Of most comfort to us, is the truth that our God has not changed! He was and is still faithful and true. His Word, the Bible, still provides comfort, peace, hope, and guidance. Our God is good all the time.

With this in mind, we want to begin by sharing with you several things that impacted the markets and the economy in 2025, and in the process review some of what went well and some of the challenges that we faced.

2025 Year In Review

Inflation – This was perhaps one of the biggest stories of the past several years. We have all been impacted by the constant rise in prices for items we use every day. For those on the lower end of the income spectrum, inflation makes life all the more difficult. Inflation is a regressive and invisible tax. It’s regressive in that its effects are felt more by the poor than the well-to-do. It’s an invisible tax in that politicians never announced it, yet it is a direct result of bad policies (of both the right and the left). When politicians do not address overspending but borrow money to keep the lights on, so to speak, they are taxing us through inflation.

Tariffs – Last year, we had a sharp increase in tariff bluster and reality. We want to acknowledge that Donald Trump’s “Liberation Day” declaration over-emphasized the potential benefit of tariffs for our nation while under appreciating their inflationary impacts. In addition, the actual tariff rates announced that day ended up being much lower after accounting for bi-lateral negotiations and specific product carveouts or exceptions. From an economic perspective, tariffs are a bad idea for our nation and the world. Tariffs are yet another example of government overreach resulting in a poorer nation, not a richer one. We are all poorer because, contrary to Trump’s assertions, tariffs are ultimately passed on to the consumer through higher prices. This is the same argument for why corporate taxes are a bad idea. No corporation pays tax, as those costs are ultimately passed down to the consumers. We are hopeful that our conservative government will return to sound monetary policy and end the use of liberal ideologies.

Job Market – The unemployment rate has also ticked higher over the past 12 months. In spite of this, the job market is not presently showing signs of distress. It does appear that many companies are slower to replace employees who are laid off, retire, or otherwise leave work. This is likely caused by both the economic uncertainty due to tariffs and slowing consumer spending, and an increased reliance on artificial intelligence (AI) to accomplish certain tasks.

Stock and Bond Markets – Over the past year we experienced some wars and rumors of wars (Ukraine, Iran, etc.), and a “tariff tantrum” in the markets last spring where the stock market retracted by nearly 20% for a short period of time. These things proved to be only slight speedbumps on the way to new market highs. One thing that we anticipated for 2025 was a rebound in the stock prices of small and medium sized companies. While small companies did better last year than in the past few years, mid-sized companies really did not perform well. International markets did extremely well in 2025, in some cases returning in excess of 30%[1]. Another expectation was that the bond market would continue to recover from the 2022 downturn. This was the case, as bonds rallied while the Fed continued to cut interest rates.

Real Estate – We believe that holding a small allocation in real estate within an investment portfolio can be prudent for some investors. One of the structures that we have used to invest in real estate within client portfolios, is through vehicles called non-traded REITs (Real Estate Investment Trusts) or Interval Funds. These investments tend to be illiquid for an indefinite period of or have limited liquidity, but offer exposure to the real estate sector, and the potential to be a diversifier from stocks and bonds. While we continue to see the value of holding some real estate in a portfolio, we acknowledge and are aware that in recent years many of these REITs and Interval funds have disappointed in their performance. As we look back on 2025, the headwinds that many of these funds experienced was one of the more challenging things from an investment perspective. While we do not want to downplay the disappointing performance of these real estate investments, we encourage our clients who own them to keep in mind that these assets are typically just one of many positions in their portfolios, usually 10% or less of the entire portfolio. For this reason and given the overall strong performance in stock and bond funds last year, our clients who hold these real estate investments still generally experienced strong positive returns in their portfolios as a whole in 2025.

Looking Ahead

While acknowledging our firm belief that only God knows the future, the following are some things that we have on our radar as we look ahead into 2026.

AI Bubble – The ongoing development of AI technology has fueled excitement in the market around companies that are leaders in AI. Because of the excitement around the revolutionary potential of AI, the stock price of some of these companies has surged far beyond their actual earnings. This is what is referred to by PE (or Price-to-Earnings) ratio. Since there are many unknowns with AI technology (how exactly it will be monetized, local resistance to building data centers, cost of electricity, etc.), it would be imprudent to let our excitement carry us away. The Biblically Responsible Investment funds that we hold in our BRI models tend to be lighter in exposure to AI investments, and given the runup in price of some of these companies, we do not plan to be actively increasing our exposure to AI at this time.

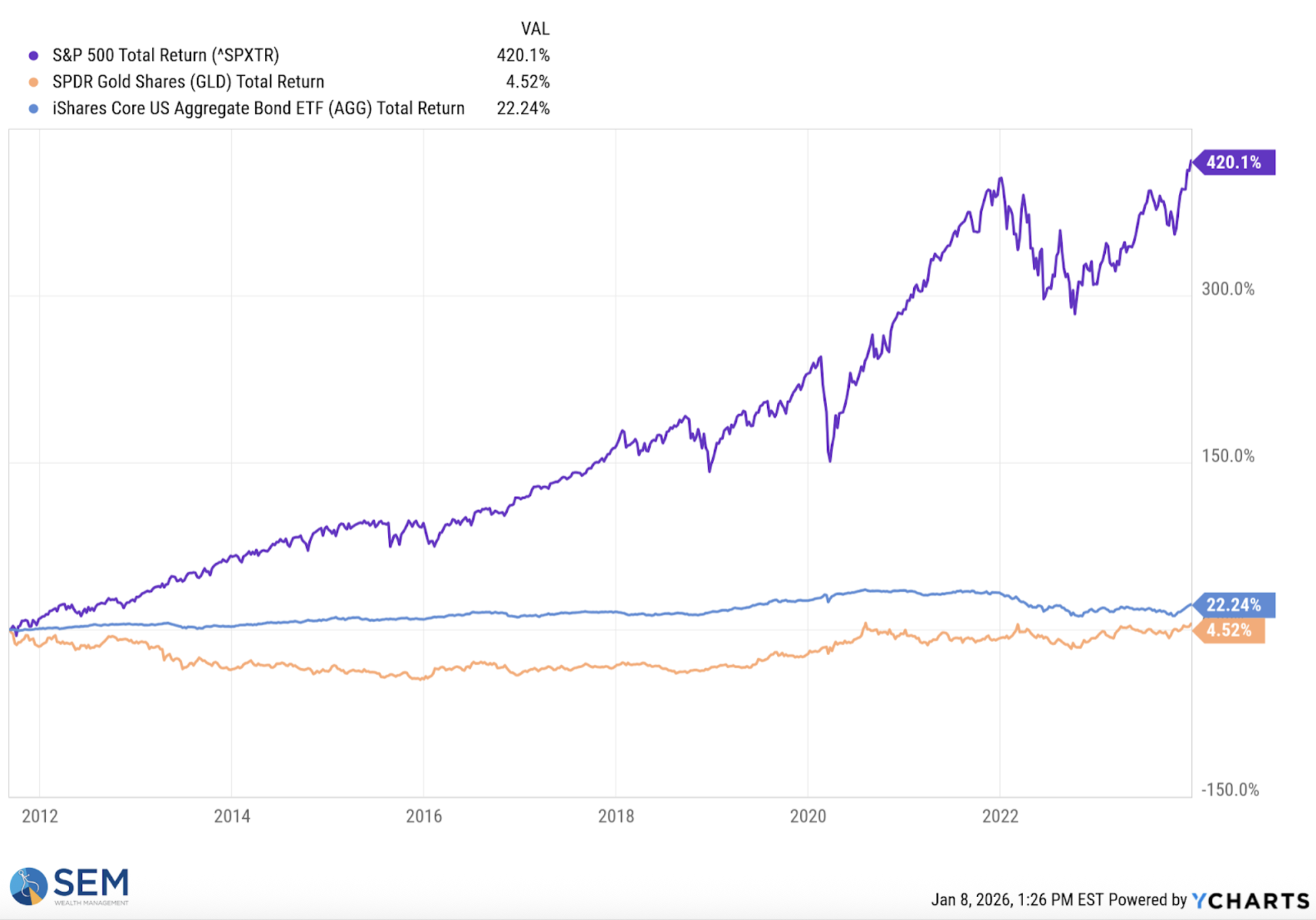

What about Gold and Silver? Gold and silver yielded spectacular returns in 2025. We are all likely seeing plenty of advertising touting the value of investing in these metals. The case made for investing in gold and silver often has to do with them being a hedge against inflation, and a devaluing of the dollar due to high debt levels. While we share these basic concerns, we are also very mindful that all investments, including gold and silver, have risk. In fact, gold and silver have been fairly volatile historically. Annualized Standard Deviation, which is a measure of an investment’s volatility, measures gold as slightly more volatile than the S&P 500 since the year 2000[2]. Prices of gold and silver can go down as fast as they go up, and just as with any asset that experiences great gain over a period of time, there is the potential of a bubble forming. To help keep the current runup on the price of gold in perspective, consider also that from September 2011 through the end of 2023, gold had a cumulative return of just 4.52%. Gold is also a currency and a commodity. As such, it does not generate earnings or growth in the same way that a business does. Its value is driven largely by supply and demand, and buying and selling. For these reasons we urge caution with regard to investing in gold and silver, and do not generally recommend these asset classes as a core position in one’s investment portfolio.

Tax Related Considerations

- Capital Gain Distributions: Many of you probably hold mutual funds in non-retirement investment accounts. If you do, then you are likely to receive taxable capital gains distributions from mutual funds as a result of the fund manager selling a stock or bond held within that fund which has appreciated in value. Those capital gains are then taxable to you in the year in which they are realized. Because we have had 3 consecutive good years in the stock market, 2025 was a year where many mutual funds, in particular stock mutual funds, had large capital gain distributions to their shareholders. We say this first, to make you aware that you may see higher taxable gains from these distributions when you go to file your 2025 tax return. Second, keep in mind that this is ultimately a good thing, as it is a result of gains within your portfolio. Finally, if you have non-retirement accounts held in a brokerage account such as Pershing (the Axiom platform), know that we are looking for opportunities to gradually transition your mutual funds to more tax efficient ETF’s (“Exchange Traded Funds”).

- Potential benefits of the “One Big Beautiful Bill”: Congress and the President passed the OBBBA in July of 2025. This bill had a number of provisions that will be impacting tax payers for the next several years, many of which are deductions or credits which will be beneficial to those who qualify. One tax change that will likely have the most positive impact on the economy are the deductions for small business owners and additional capital expenditure incentives for businesses. Another benefit which can positively impact persons age 65 and older, is a temporary provision for years 2025-2028 that gives the potential for an additional $6,000 per individual deduction on your tax return, subject to income limits. Note that this is NOT an elimination of tax on Social Security benefits as some have been led to believe. It can however, help to mitigate some tax liability for those who qualify.

What Should You Be Doing?

- Take risk seriously. While it may be prudent to continue to own certain asset classes that have performed well, we do not advise “chasing returns” or overweighting a particular investment just because it has done well or is generating media buzz.

- Instead, remain diversified. None of us can predict the future, and therefore no one but God knows what investments will perform well and what will perform not so well going forward. While you have probably heard us say this over and over, diversification remains prudent to the investment process!

- Continue to keep ample cash (i.e., funds in savings and money market accounts) on hand for emergencies and shorter-term planned expenses.

In conclusion, we want to express our gratitude to you for allowing us to come alongside you and advise you in your investment and financial planning! It is truly our honor to do so, and we take seriously the confidence you have placed in us to serve you in this way. May we together be humble and dependent upon God, and may our ultimate confidence be in Him as we embark upon another year together.

Yours in Christ,

LFG Advisory Team

Stay Connected

Have questions or topics you’d like us to cover in a future episode? Email us at contact@thelifegroup.org with “Life in the Markets” in the subject line.

✅ Like, comment, and subscribe on YouTube

🎧 Listen to the audio podcast wherever you get your shows

📘 Pick up a copy of The Good Steward to grow in your financial discipleship

[1] Per finance.yahoo.com, the broadly diversified ishares MSCI EAFE ETF (EFA) shows a return of 31.55% for calendar year 2025.

[2] Per YCharts, annual standard deviation of the gold ETF GLD is 16.98% and the S&P 500 ETF SPY is 15.81%.

Disclaimer: The topics discussed here are for informational purposes only and do not constitute specific investment advice. Investing involves risks, including potential loss of principal. Past performance does not guarantee future results. Securities and advisory services offered through Geneos Wealth Management, member FINRA/SIPC.